In today’s fast-moving world, people are becoming more aware of financial planning. Two essential pillars of financial stability are insurance and tax planning. Interestingly, both of these areas often go hand in hand. Many people take insurance only to protect their loved ones or assets, but what they often miss is that insurance can also offer significant tax benefits.

Let’s explore how insurance not only secures your life, health, or property but also helps you save money by reducing your taxable income.

What is Insurance?

Insurance is a contract between you and an insurance company. You pay a fixed amount (called a premium), and in return, the company promises to support you financially in case of a covered loss, such as an accident, illness, or death.

There are various types of insurance:

- Life insurance – financial protection for your family after your death

- Health insurance – covers medical bills and hospital costs

- Vehicle insurance – protects your car or bike from damage or theft

- Home insurance – protects your house from fire, theft, or natural disasters

Each type of insurance plays a different role, but all serve one purpose: to reduce your financial burden in times of need.

Tax Benefits of Insurance

Now, let’s talk about the real benefit most people overlook—tax savings. Governments around the world, including in countries like India, the UK, and the US, offer tax deductions and exemptions on certain insurance policies to encourage people to get insured.

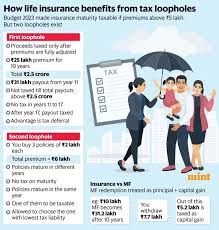

1. Life Insurance Tax Benefits

Most governments allow tax deductions on the premium paid towards life insurance under specific sections of their income tax laws. For example:

- In India, under Section 80C, the premium paid for life insurance (up to ₹1.5 lakhs per year) is tax-deductible.

- The maturity amount and death benefit are also usually tax-free under Section 10(10D).

This means you’re not just protecting your family’s future but also lowering your taxable income.

2. Health Insurance Tax Benefits

Health insurance is another area where you can enjoy dual benefits—healthcare protection and tax savings.

- In India, under Section 80D, individuals can claim a deduction of up to ₹25,000 (₹50,000 for senior citizens) on premiums paid for themselves or their family.

- In the US, certain health insurance premiums are deductible if you’re self-employed or itemizing your tax return.

- In the UK, private health insurance may offer some tax advantages for businesses offering it as a perk.

So, getting a good health plan isn’t just a smart move for medical reasons, it’s a wise tax strategy too.

3. Other Types of Insurance

Some home insurance and vehicle insurance may offer limited tax benefits, especially if they are part of a business expense. If you’re using a vehicle for professional use, a portion of the insurance cost may be deductible.

Why Insurance and Tax Planning Go Together

Tax planning should never be your only reason to buy insurance—but it’s certainly a great additional benefit. Insurance ensures peace of mind, while tax deductions put extra money back into your pocket.

So, when you’re making your yearly tax-saving investment plan, don’t forget to include insurance policies in it. It’s like hitting two birds with one stone: safety + savings.

Conclusion

Insurance is not just about paying premiums and waiting for unfortunate events. It’s about being smart, secure, and financially prepared. With proper planning.

Leave a Reply